Archives Page

Interview with Michael Hudson, CEO of Mawson Resources

The following are the on-the-record questions from a recentinterview between theinvestar.com and Michael Hudson, CEO of Mawson Resources.

Theinvestar.com: Since we reintroduced Mawson to ourclients and readers, the stock is up 100%, fueled by the company’s deploymentof its large cash holdings into new projects, most notably two highlyprospective gold properties. Can you tell us about the company’s currentfocus?

Michael Hudson: Mawson is a gold and uraniumexploration company focused in Scandinavia and Peru.

The current project focus for the Company is the Rompasproject in Finland, a new discovery with bonanza gold where samples up to12,800 g/t (373 oz/ton) gold and 43.6% uranium have been identified. Inaddition, the Company is exploring for gold and copper in the highlyprospective Cordillera of Peru (true “elephant” country), with a focus on a newhigh grade gold discovery at Alto Quemado. Areva NC, holds 11% of Mawson on the basis of thesignificant hard rock uranium resources and exploration projects held by Mawsonin Scandinavia. Mawson has many drill-ready uranium targets to be tested.

Theinvestar.com: Could you give us your bestestimates regarding the timetable of exploration milestones for the two goldprojects? (Specifically field work and when it will be done, airborne geo,drilling and further sampling)

Michael Hudson: Substantial field teams are already workingin Finland and Peru and will create a steady stream of data and news flow forthe remainder of 2010.

At Rompas, the work program is focused on the 6km Au-Umineralized discovery trend to outline the extent and controls onmineralization and define the highest priority drill targets. In addition,work is underway to discover additional mineralization elsewhere within theCompany's extensive 95,000 hectare land holding. Thousands of soil and rockchip samples are currently being collected together with mapping and furtherprospecting. A 3,200 line km airborne geophysical survey will commence in lateAugust.

Being such a new discovery, the permits at Rompas remain in theapplication stage, although being 100% secured. During the application stagewe cannot drill and trench, but can perform all other forms of exploration. Mawson is working with the Finnish authorities to clarify timing of granting.

In Peru, a team of 12 is busy mapping and sampling the highgrade structures and porphyry target zone at surface and underground for thefirst time. This program will define drill targets. The Company aims to seekpermission to drill these targets in 2011.

Theinvestar.com: Where do you see Mawson in the next12 months? 24 months?

Michael Hudson: Exploration is an enticing businessthat can change dramatically with one result in the very short term, asevidence by the renewed interest in Mawson and its Rompas property.

Nevertheless, our vision is simple. At Rompas our desire isto outline a major gold discovery. Initial surface indications of the grade ofgrab samples taken over a 6km trend are very encouraging; however a lot of rigorousand diligent exploration work remains in order for Mawson to succeed in itsvision.

Similarly in Peru the vision is to make a major discovery tocreate large upside for Mawson investors. At Alto Quemado we have two targetson the one property: the porphyry zone and high grade gold structures. We aimto increase our exposure through Peru given Peru’s “elephant country” status tohost world class ore bodies.

Additionally the company holds significant NI43-101 uraniumresources in Scandinavia. The Hotagen district in Sweden remains the mostpromising with 100’s of ore-grade uranium outcrops around the 3.3Mlb indicatedNI43-101 resource at Klappibacken. Further exploration will be required tobuild on the known resource base.

Theinvestar.com: Where does the company’s treasurycurrently stand at? Is that amount cash or other highly conservativeinstruments…in other words, no high yield commercial paper, correct?

Michael Hudson: We hold +$9M cash in a Tier 1Canadian bank with no exposure to commercial paper. Additionally the companyholds shares in Canadian and Australia listed exploration companies as a resultof property transactions which are currently valued at around C$0.6M.

Theinvestar.com: What can shareholders expectregarding expenditures for the year?

Michael Hudson: Over the next year we should spend inthe order of C$3.5M with a focus on both Rompas and Alto Quemado.

Theinvestar.com: Will Mawson need to raise money inthe near future?

Michael Hudson: Mawson is well funded and we do notneed to raise funds in the short term. However we never rule out theopportunity to raise further cash at an appropriate moment.

Theinvestar.com: As a percentage, where will Mawsonbe spending exploration dollars in the next 24 months? First by country, thenby target (i.e., uranium, gold, etc.).

Michael Hudson: Finland gold 55% Peru gold and copper 30% Sweden uranium 15%

Theinvestar.com: It seems the story regarding Mawsonseems to be getting out, stock up over 100%, and share volume surging. HasMawson been alerted regarding any new large shareholders?

Michael Hudson: We have had a lot of recent interestin Mawson with the addition of Areva as a major shareholder and the announcementof the Rompas property. Areva’s investment provides an underlying credibilityto both the Company and management while Rompas provides a compelling earlystage exploration story.

Theinvestar.com: What investor shows will you beattending if any, over the next year?

Michael Hudson: Mawson will have presentation boothsat least at the following conferences over the next 7 months:

New Orleans Gold Show – Oct 2010 San Francisco Hard Assets Conference – Nov 2010 Vancouver Hard Assets Conference – Jan 2011 PDAC Toronto – March 2011

We will review our IR planning post March 2011.

Theinvestar.com: Is the deal in Peru closed yet, has Mawson formally taken title to the project?

Michael Hudson: We closed 93% of the deal on Aug 4th2010. We are aiming to close the remaining 7% shortly.

Theinvestar.com: What is management’s shareholding inthe company currently at, not including options?

Michael Hudson: 12%

Theinvestar.com: What do you make of the recent risein U3O8 pricing?

Michael Hudson: The recent uptick has broken a yearlong down trend so that is a positive. There is also much discussion over thelast few months that there are more buyers seeking long term off takeagreements with near or current producers. I do not think anyone questions therationale behind the next uranium boom – the only question remains the time fordemand dynamics to overwhelm the current primary and secondary uraniumsupplies.

Theinvestar.com: Do you think the small guy can bringa project from exploration to production alone in the current environment?

Michael Hudson: It all depends on the type and scaleof project including but not limited to potential capex and payback. Mawsonhas partnered with Areva, the natural partner to bring any potential futureEuropean uranium mines into production.

Theinvestar.com: It seems China has a huge appetitefor Australian miners and explorers and have built up some relationships inthat country over the years. Does Mawson have any connections with China, or open avenues?

Michael Hudson: We are in contact with a variety ofgroups, obviously Areva for uranium and we have had a lot of interest from avariety of groups interested in learning more about our gold projects in Finland and Peru.

Theinvestar.com: At current levels, do you thinkMawson is undervalued, fairly valued, or overvalued? And why?

Michael Hudson: Mawsonis well financed with a diverse range of exciting mineral properties from grassroots to resources projects in stable mining friendly jurisdictions known tohost large ore bodies. Mawson has momentum and with results just starting toflow, there is a lot of potential upside that remains to be unlocked.

Theinvestar.com: Do you see further industryconsolidation in the years ahead? If so, who do you think the players will be(consolidators and sellers)? How does Mawson fit into this picture?

Michael Hudson: The mining industry is all aboutscale and consolidation. The industry is now dominated by a few major players– with a vacuum created in the mid tier level. This creates greatopportunities for the next level of juniors who will fill that vacuum – andthat is where Mawson sees itself moving as it develops its projects.

Theinvestar.com: Could you update us on the currentpolitical situation regarding exploration and development in the jurisdictionsin which you have projects?

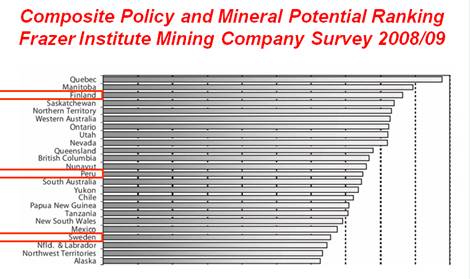

Michael Hudson: I think this is best answered by onegraph which shows Mawson is exploring in 3 of the top 20 countries on aworldwide basis, including in Finland which ranks at number 3 on the lastFrazer Institute Annual Company Survey

Theinvestar.com: Could you give us an update on whereyou feel the uranium price is headed over the short, medium and long-term? Both the spot and long-term contracts.

Michael Hudson: There are currently 438 nuclear powerplant units, 61 plants under construction and 316 nuclear power plants plannedor proposed so the long term bullishness regarding uranium demand is well founded. There remains a long term contango in the uranium market with long term pricesstill much higher that spot prices and many people predict these prices toconverge over the medium term. I think we are starting to see some short termdemand for tying up uranium supplies and this is perhaps reflected in theupward movement of the spot price. Another key factor will be the cost toproduce a Lb of uranium in the future. I do not know of many proposed minesthat will be able to produce under $60/lb cash cost so this will alsopositively affect the uranium price resistance level.

Theinvestar.com: Also, regarding Europe, what are thecurrent feelings regarding nuclear power? If memory serves me correctly, theSwedes and Germans were talking about allowing some of their older plants’licenses to lapse and wind down their nuclear operations, and then there werereports that maybe this was not such a great idea. Have you heard anythingconcrete about plans for the future? Will we see new plants built outside of France beyond what is currently planned, or will investors have to count on the Asians andBrazilians to increase demand through expansion of their nuclear powerindustry?

Michael Hudson: The Nordic countries are undergoing anuclear renaissance. The politics of uranium have moved favorably since wefirst commenced our uranium operations in 2005. Some major recent highlightsfrom Sweden, which derives close to 50% of its power needs from uranium, include:

In Finland, where nuclear power accounts for 27% ofelectricity, a similar trend has been noted:

Theinvestar.com: As always Michael thank you for yourtime.

© theinvestar.com, LLC - read disclaimer

|

|