Archives Page

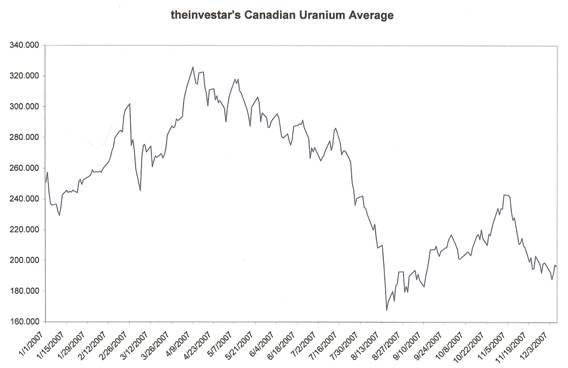

Miserable No Longer? The past few weeks have been quite difficult for uranium investors as the market in general remains reluctant to take on risk. This risk aversion has led uranium equities downwards with some companies' stocks either at or approaching multi-year lows and our uranium index once again near this year's lows. Until the market as a whole has a good feeling for what to expect with the mortgage related write-downs, volatility will most certainly surround such high risk, high reward situations such as our junior uranium mining stocks. Some stocks have faired quite poorly this year as investor's shore up their cash positions and lock in gains before they have the opportunity to lose them. On the other hand, there are some stocks which have certainly delivered stellar returns to their shareholders during this market downturn. The difference between these companies, the winners and the losers, is that those who are up have provided good news to the investment community while the losers have reported poor news or no news at all. In these types of markets it IS possible for no news to be bad news. UEX (UEX.TO) has reported very good grades as they continue to drill with AREVA at Shea Creek which has provided the fuel to power the stock up to new all-time highs recently. Paladin (PDN.TO) and Uranium One (UUU.TO) have not been so fortunate. Both have failed to meet their production goals and been taken to the woodshed by investors for their poor performance. In markets such as the one we are currently in, investors do not like surprises and are less willing to allow a pass for poor performance as they may during a powerful bull market plowing forward. We are in a type of correction here, but it seems that it should be short lived. This may be a type of consolidation period which lasts for 12-18 months or so as investors lick their wounds and begin to test the waters once again (but let us all remember that this really started in March, so we are just a few months from reaching the 12 month milestone). With China and other developing countries' desire to build nuclear plants to fuel their spectacular growth growing, uranium equities could once again come into favor with investors. Keep in mind that the engineering firms who build these plants are holding up much better and continue to announce new deals. AREVA's deal with China this week is further evidence of the desire to add large, cheap, emission clean energy to their grids. With all of that said, the argument can be made that now is a perfect time to SMARTLY add to positions in your portfolio or begin buying new positions altogether. At these prices we believe that there is some value to be found, especially in the top-tier companies. The top-tier will be the group which experiences the first money inflows once investors come back into the market. So, one should keep an eye on Uranium One (UUU.TO), Paladin (PDN.TO), Denison Mines (DML.TO, DNN), UR-Energy (URE.TO), and lastly Strathmore Minerals (STM.V). Cameco (CCO.TO, CCJ) would also be an interesting play, however they are experiencing major operational deficiencies right now so the risk is a bit high. For American investors trying to get exposure to Aurora Energy (AXU.TO), a company we like very much and believe the Central Mineral Belt of Labrador holds massive potential, look no further than Frontier Development Group (FRG) which is traded on the Amex.

It seems that for the time being investors have decided to lower their risk and sold down the uranium equities. The index has found support at the 190 level and has traded in a range of 190 to 200 recently. Although the uranium index is near the yearly lows, many of the stocks have begun to act out of character. On top of this we notice that some companies' stocks have been propelled to dramatically higher prices on good news, which is not out of the ordinary but our point is that it was GOOD news and not GREAT news. Great news would have warranted some of these reactions, while good news should have been something a little less. What does this tell us? Well for one it tells us that

investors still have an appetite for risk at this point and are waiting for the

right opportunity to once again enter the uranium investing arena. After getting

burnt so bad for nearly 12 months, they should not be this anxious, but they

are. Many investors will be taking losses this year to match gains for tax

purposes so there may be a small window to add to your holdings at bargain

prices. Also of importance is the fact that when the market gets hot, it spikes

quickly, and 10% moves (both up and down) are the norm during those cycles for

many equities. Everyone wants to 'buy on the dips' but few recognize those dips

as the market corrections they are instead of the end of an investment

opportunity; in short we believe this to be a dip to buy uranium equities.

© theinvestar.com, LLC - read disclaimer

|

|