Archives Page

The Shot Heard 'Round the World Big Ben came around for the equities markets again dropping rates by 50 basis points, nearly double what the consensus was but in line with the most optimistic calls. In response US markets rose, along with equities markets around the world. Commodities rose around the world too buoyed by the new weak dollar, and the dollar fell in response to many currencies around the world. Looking for interesting moves, we noticed that the Canadian dollar is roughly on par with the US dollar (C$1=US$.9842) highlighting the dramatic run-up in commodities prices in the past few years and economic strength in those countries. Australia’s dollar also ended higher finishing at .8517 to US$1 which is not an all-time high, but getting closer to it (around A$.88).

As we look at the moves these two currencies have had against the US dollar we amazed. Currencies rarely post such large gains against each other, let alone the hallowed US dollar, in one year! This shows the true strength behind the current commodities super-cycle.

The Canadian dollar has an impressive uptrend where it “rises from the bottom left of the chart to the top right of the chart.” Oil was the driving force early on, but so long as this commodities boom lasts, the uptrend shall continue. These currencies will most likely rack up more gains versus the US dollar, however one must believe that the highs set by the Euro against the US dollar will not hold for too much longer. The Europeans are having some serious problems with mortgage woes which were exported to them via the US, and Britain may have to lower rates as well as their banks are experiencing the same problems. Northern Rock PLC, a major mortgage lender in Britain saw many of its customers line up outside the company’s branches this week to withdraw their savings as it was announced that the company is experiencing many problems. The Bank of England has guaranteed the deposits at the bank, but this could be the beginning of something much bigger. Also, remember that the Europeans have been a bit behind the learning curve when it comes to reacting to events such as these, most likely due to the structure of the European Union and needing to please all parties…but who would not want a rate cut?!?! My belief is that Europe will play follow the leader just as they did when the mortgage crisis hit, and Britain could follow soon after.

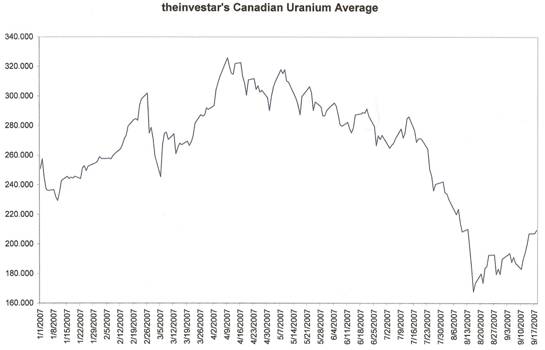

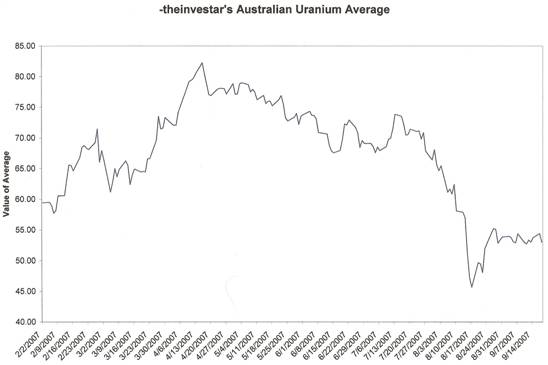

It appears that a rally is already in place in Canada as we have the start of a new uptrend. Uranium equities have been looking stronger over the past few trading days in Canada, but we are basically flat for the past two weeks in Australia. The announcement of the rate cut yesterday had nearly no effect upon trading in the uraniums, in fact we noticed that a few actually moved lower. No reason to panic here, we were the first to get nailed and shall be the last to emerge from the destruction created by the sub-prime mortgage woes. This has nothing to do with the fundamentals, but rather just market psychology. Risk is first to be weeded out of a portfolio during bad times, and the last to be added once the market begins a new move up.

Australia has bounced off its lows, but everyone is waiting for a move here as Australian uraniums have begun to flat-line over the past two weeks. Spot uranium is due for a reversal from its latest trends soon. Oil has risen higher, to all-time highs in fact (unadjusted for inflation of course), and many experts are beginning to believe that natural gas is heading higher as well. One interesting point to make is that the US Southeast may be in for a cold winter this year, and many of the homes are heated by natural gas with the rest using heating pumps powered for the most part by nuclear power plants. It was one of the hottest summers on record, but now daily temperatures range from 60 to 80 degrees…much cooler than this time last year. This is something to watch out for in regards to the energy sector in general because utilities will most likely be asking for rate hikes due to increases in energy costs and leave politicians asking why we cannot have cheaper electricity bills. Nuclear anyone? One other point of interest is that the spot market trades sporadically, thus allowing prices to surge and collapse (quite literally) sometimes on one order. Let us point out that the recent collapse is in partly caused by government interference coupled with a mass exodus of private equity interest. Keep in mind that the US Department of Energy announced they would possibly be selling around 200,000 lbs. U3O8 earlier in the year. Everyone knew that this was coming to market, so utilities did not jump at the opportunity to purchase materials from those hedge funds who wanted to sell their holdings at what we now know to be the top. It is quite possible that the market was forced down maybe 20% with this looming on the horizon. This material is now not an issue for the market now, and we must look ahead…and the future really looks bright indeed. Still world production is far from filling the world demand, and the supply/demand ratio appears to be getting worse instead of better. If you look in our free report (The North American Uranium Review, Fall 2007) available through the Uranium Companies section you can find some interesting graphs illustrating future nuke plant plans, and the numbers are becoming mind boggling. Investigating the numbers of when plants are to be completed and anticipated mine production, we appear to close the gap through 2015, but if any of these plans for new plants materialize then we could be looking at a whole new supply problem. We have been adding to positions already maintained in our

portfolio over the past few weeks and still maintain our beliefs in this sector.

News flow will be picking up and we should experience a steady stream over the

next few months which could propel us to higher levels across the board. This is

a time to add to positions but not attempt to do anything drastic as mortgage

woes may still plague us further down the road.

© theinvestar.com, LLC - read disclaimer

|

|