Archives Page

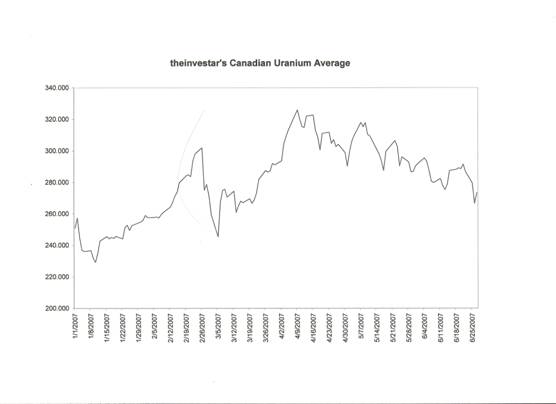

So Close to the Bottom The spot uranium price seems to have stalled at its current level, quite possibly because it appeared that there would be many willing sellers at these prices. However, although the price stalled, 2 of the auctions were halted and undoubtedly postponed. Eventually these supplies will come to market, but most assuredly the sellers will not be foolish enough to time them back-to-back-to-back as was attempted. Along with the pause, or breather if you will, in U3O8 prices we have also seen uranium stocks not only stall, but break down! In fact, the downtrend is still intact, and after the most recent lows we were about 5% from what we believe will be the bottom this summer. We could almost smell the blood in the streets on Tuesday, and had Wednesday been another down day to continue the trend we may have thought that the end was near. Instead, Tuesday's sell-off was most likely some funds taking profits, or at the very least moving some money around, and not the margin calls and panic selling that will be required to begin the next leg of this bull run. See the chart for yourself and you will understand what we are talking about. Every time we have a new low, the market rebounds and so long as that trend continues, the index trend shall continue downwards as well. We will need to literally bottom out and have a pause, because at this point many of the stocks in the index simply appear to be bouncing off of support levels which investors perceive indicate the stock cannot go any lower. We need to see more of these supports broken across the board, and at that time will no the end is near.

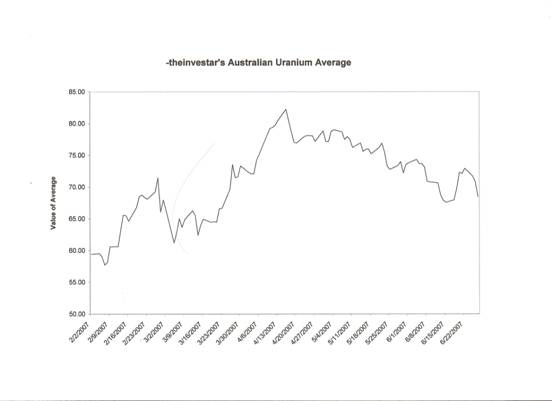

We had also begun to scour through our portfolio for stocks to double down on when the time was right, and we had on Monday made a trade on an upcoming merger with one of our Labrador picks. On Monday we purchased what was an initial “nibble” at Universal Uranium thinking that their spun-off properties would be worth more than those being spun off from Silver Spruce (one of our original Labrador picks). It appears that a certain newsletter writer sent out an email to subscribers with a bullish recommendation in regards to Silver Spruce and the upcoming merger. SSE was up roughly 35% on Tuesday, which resulted in it and UUL being just about the only U3O8 stocks ending the day in positive territory. At this point one must take a look at both sides of the trade, and figure out which assets from the spin-off are more desirable, but our main interest is in the Labrador properties themselves. Our belief has always been that one of our picks from our move into the Labrador area would result in 'the next Aurora' and Silver Spruce may be just the stock now. They will own 100% of the Two Time Zone property and have plenty of other property to drill. Only time will tell, however at this time it appears that this is the way to play further exploration in the Central Mineral Belt. Australia has been in the same funk as Canada with a downtrend that remains intact. Buy on the rumor and sell on the news seems to be the case here as the current downturn began at the time Parliament approved overturning the 'Three Mines Policy'. Denison's second proposal to Omega Corp. may help end the funk, however it is going to take a rich premium to bring the entire market back to life and DML is not the player who will pay a rich price. On the horizon we have SXR making a purchase, but this will not be until after they close the Energy Metals acquisition. They are looking for Australian assets, so they will most likely try and go after an Australian “pureplay” as opposed to an Australian company with assets overseas.

Although we have not reached a bottom, we are buyers of

quality plays at these levels. Mawson, Strathmore, and Ur-Energy are our

favorites at this time due to their current valuations, however soon we will be

able to deploy our capital across the board to fully reap the benefits of the

next rally.

© theinvestar.com, LLC - read disclaimer

|

|